India ETFs List

List of US traded ETFs tracking the Indian stock market:

WisdomTree India Earnings Fund (EPI)

PowerShares India Portfolio ETF (PIN)

iPath MSCI India Index ETN (INP)

Are India ETFs worth buying today? Click here to find out.

Natural Gas ETFs List

List of US listed natural gas ETFs:

Dow Jones-AIG Natural Gas Total Return ETN (GAZ)

First Trust Natural Gas (FCG)

United States Natural Gas Fund (UNG)

Are natural gas ETFs worth buying now? Click here to find out.

Leveraged Currency ETFs List

List of leveraged currency ETFs:

Market Vectors Double Long Euro ETN (URR)

Market Vectors Double Short Euro ETN (DRR)

ProShares Ultra Euro ETF (ULE)

ProShares Ultra Yen ETF (YCL)

ProShares UltraShort Euro ETF (EUO)

ProShares UltraShort Yen ETF (YCS)

Note: URR and DRR are ETNs (exchange traded notes).

Are any of those currency ETFs worth buying today? Click here to find out.

Short Financials ETFs

Short (inverse) financials ETFs list:

Financial Bear 3X – Triple-Leveraged ETF (FAZ)

ProShares Short Financials ETF (SEF)

ProShares UltraShort Financials (SKF)

Rydex Inverse 2x S&P Select Sector Financial ETF (RFN)

Are any of those ETFs worth buying right now? Find out what the best performing ETFs are right now and how you can improve your portfolio return. Click Here Now!

Bond ETFs List

List of US traded bond ETFs.

1-30 Treasury Ladder Portfolio ETF (PLW)

Active Low Duration Fund (PLK)

Ameristock/Ryan 1 Year Treasury ETF (GKA)

Ameristock/Ryan 10 Year Treasury ETF (GKD)

Ameristock/Ryan 2 Year Treasury ETF (GKB)

Ameristock/Ryan 20 Year Treasury ETF (GKE)

Ameristock/Ryan 5 Year Treasury ETF (GKC)

Claymore U.S. Capital Markets Bond ETF (UBD)

Claymore U.S. Capital Markets Micro-Term Fixed Income ETF (ULQ)

Claymore U.S.-1-The Capital Markets Index ETF (UEM)

Emerging Markets Sovereign Debt Portfolio ETF (PCY)

Ext Duration Treasury ETF (EDV)

High Yield Corporate Bond Portfolio ETF (PHB)

Insured CA Municipal Bond Portfolio ETF (PWZ)

Insured National Municipal Bond Portfolio ETF (PZA)

Insured NY Municipal Bond Portfolio ETF (PZT)

Inter-Term Bond ETF (BIV)

iShares iBoxx $ High Yield Corporate Bond Fund (HYG)

iShares iBoxx US Dollar Investment Grade Corporate Bond Fund (LQD)

iShares JPMorgan USD Emerging Markets Bond Fund (EMB)

iShares Lehman 1-3 Year Credit Bond Fund (CSJ)

iShares Lehman 1-3 Year Treasury Bond Fund (SHY)

iShares Lehman 10-20 Year Treasury Bond Fund (TLH)

iShares Lehman 20+ Year Treasury Bond Fund (TLT)

iShares Lehman 3-7 Year Treasury Bond Fund (IEI)

iShares Lehman 7-10 Year Treasury Bond Fund (IEF)

iShares Lehman Aggregate Bond Fund (AGG)

iShares Lehman Credit Bond Fund (CFT)

iShares Lehman Government/Credit Bond Fund (GBF)

iShares Lehman Intermediate Credit Bond Fund (CIU)

iShares Lehman Intermediate Government/Credit Bond Fund (GVI)

iShares Lehman MBS Fixed-Rate Bond Fund (MBB)

iShares Lehman Short Treasury Bond Fund (SHV)

iShares Lehman TIPS Bond Fund (TIP)

iShares S&P California Municipal Bond Fund (CMF)

iShares S&P National Municipal Bond Index Fund (MUB)

iShares S&P New York Municipal Bond Fund (NYF)

Long-Term Bond ETF (BLV)

Market Vectors – Lehman Brothers AMT-Free Short Municipal Index ETF (SMB)

Market Vectors AMT-Free Long Municipal Index ETF (MLN)

Market Vectors Intermediate Municipal Index ETF (ITM)

ProShares UltraShort Lehman 20+ Year Treasury Bond ETF (TBT)

ProShares UltraShort Lehman 7-10 Year Treasury Bond ETF (PST)

Short-Term Bond ETF (BSV)

SPDR Barclays Capital TIPS ETF (IPE)

SPDR DB International Government Inflation-Protected Bond ETF (WIP)

SPDR Lehman 1-3 Month T-Bill ETF (BIL)

SPDR Lehman Aggregate Bond ETF (LAG)

SPDR Lehman California Municipal Bond ETF (CXA)

SPDR Lehman High Yield Bond ETF (JNK)

SPDR Lehman Intermediate Term Treasury ETF (ITE)

SPDR Lehman International Treasury Bond ETF (BWX)

SPDR Lehman Long Term Treasury ETF (TLO)

SPDR Lehman Municipal Bond ETF (TFI)

SPDR Lehman New York Municipal Bond ETF (INY)

SPDR Lehman Short Term Municipal Bond ETF (SHM)

Total Bond Market ETF (BND)

VRDO Tax-Free Weekly Portfolio ETF (PVI)

Are any of those ETFs worth buying right now? Find out what the best performing ETFs are right now and how you can improve your portfolio return. Click Here Now!

Double Exposure ETFs List

List of US traded double leveraged ETFs :

Market Vectors Double Long Euro ETN (URR)

Market Vectors Double Short Euro ETN (DRR)

PowerShares DB Agriculture Double Long ETN (DAG)

PowerShares DB Agriculture Double Short ETN (AGA)

PowerShares DB Base Metals Double Long ETN (BDD)

PowerShares DB Base Metals Double Short ETN (BOM)

PowerShares DB Commodity Double Long ETN (DYY)

PowerShares DB Commodity Double Short ETN (DEE)

PowerShares DB Crude Oil Double Long ETN (DXO)

PowerShares DB Crude Oil Double Short ETN (DTO)

PowerShares DB Gold Double Long ETN (DGP)

PowerShares DB Gold Double Short ETN (DZZ)

ProShares Ultra Basic Materials ETF (UYM)

ProShares Ultra Consumer Goods ETF (UGE)

ProShares Ultra Consumer Services ETF (UCC)

ProShares Ultra DJ-AIG Commodity ETF (UCD)

ProShares Ultra DJ-AIG Crude Oil ETF (UCO)

ProShares Ultra Dow 30 ETF (DDM)

ProShares Ultra Euro ETF (ULE)

ProShares Ultra Financials ETF (UYG)

ProShares Ultra Gold ETF (UGL)

ProShares Ultra Health Care ETF (RXL)

ProShares Ultra Industrials ETF (UXI)

ProShares Ultra MidCap 400 ETF (MVV)

ProShares Ultra Oil & Gas ETF (DIG)

ProShares Ultra QQQ ETF (QLD)

ProShares Ultra Real Estate ETF (URE)

ProShares Ultra Russell 1000 Growth ETF (UKF)

ProShares Ultra Russell 1000 Value ETF (UVG)

ProShares Ultra Russell 2000 ETF (UWM)

ProShares Ultra Russell 2000 Growth ETF (UKK)

ProShares Ultra Russell 2000 Value ETF (UVT)

ProShares Ultra Russell MidCap Growth ETF (UKW)

ProShares Ultra Russell MidCap Value ETF (UVU)

ProShares Ultra S&P 500 ETF (SSO)

ProShares Ultra Semiconductors ETF (USD)

ProShares Ultra Silver ETF (AGQ)

ProShares Ultra SmallCap 600 ETF (SAA)

ProShares Ultra Technology ETF (ROM)

ProShares Ultra Telecommunications ETF (LTL)

ProShares Ultra Utilities ETF (UPW)

ProShares Ultra Yen ETF (YCL)

ProShares UltraShort Basic Materials ETF (SMN)

ProShares UltraShort Consumer Goods ETF (SZK)

ProShares UltraShort Consumer Services ETF (SCC)

ProShares UltraShort DJ-AIG Commodity ETF (CMD)

ProShares UltraShort DJ-AIG Crude Oil ETF (SCO)

ProShares UltraShort Dow 30 ETF (DXD)

ProShares UltraShort Euro ETF (EUO)

ProShares UltraShort Financials ETF (SKF)

ProShares UltraShort FTSE/Xinhua China 25 ETF (FXP)

ProShares UltraShort Gold ETF (GLL)

ProShares UltraShort Health Care ETF (RXD)

ProShares UltraShort Industrials ETF (SIJ)

ProShares UltraShort Lehman 20+ Year Treasury Bond ETF (TBT)

ProShares UltraShort Lehman 7-10 Year Treasury Bond ETF (PST)

ProShares UltraShort MidCap 400 ETF (MZZ)

ProShares UltraShort MSCI EAFE ETF (EFU)

ProShares UltraShort MSCI Emerging Markets ETF (EEV)

ProShares UltraShort MSCI Japan ETF (EWV)

ProShares UltraShort Oil & Gas ETF (DUG)

ProShares UltraShort QQQ ETF (QID)

ProShares UltraShort Real Estate ETF (SRS)

ProShares UltraShort Russell 1000 Growth ETF (SFK)

ProShares UltraShort Russell 1000 Value ETF (SJF)

ProShares UltraShort Russell 2000 ETF (TWM)

ProShares UltraShort Russell 2000 Growth ETF (SKK)

ProShares UltraShort Russell 2000 Value ETF (SJH)

ProShares UltraShort Russell MidCap Growth ETF (SDK)

ProShares UltraShort Russell MidCap Value ETF (SJL)

ProShares UltraShort S&P 500 ETF (SDS)

ProShares UltraShort Semiconductors ETF (SSG)

ProShares UltraShort Silver ETF (ZSL)

ProShares UltraShort SmallCap 600 ETF (SDD)

ProShares UltraShort Technology ETF (REW)

ProShares UltraShort Telecommunications ETF (TLL)

ProShares UltraShort Utilities ETF (SDP)

ProShares UltraShort Yen ETF (YCS)

Rydex 2x Russell 2000 ETF (RRY)

Rydex 2x S&P 500 ETF (RSU)

Rydex 2x S&P MidCap 400 ETF (RMM)

Rydex 2x S&P Select Sector Energy ETF (REA)

Rydex 2x S&P Select Sector Financial ETF (RFL)

Rydex 2x S&P Select Sector Health Care ETF (RHM)

Rydex 2x S&P Select Sector Technology ETF (RTG)

Rydex Inverse 2x Russell 2000 ETF (RRZ)

Rydex Inverse 2x S&P 500 ETF (RSW)

Rydex Inverse 2x S&P MidCap 400 ETF (RMS)

Rydex Inverse 2x S&P Select Sector Energy ETF (REC)

Rydex Inverse 2x S&P Select Sector Financial ETF (RFN)

Rydex Inverse 2x S&P Select Sector Health Care ETF (RHO)

Rydex Inverse 2x S&P Select Sector Technology ETF (RTW)

Are any of those ETFs worth buying right now? Find out what the best performing ETFs are right now and how you can improve your portfolio return. Click Here Now!

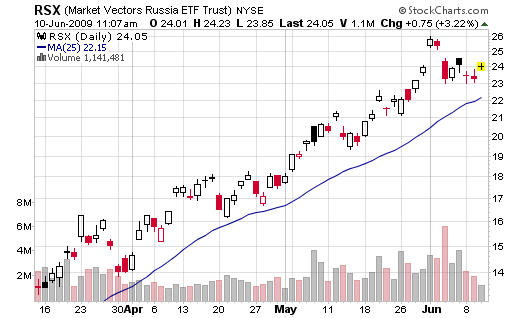

Best ETF for June 2009

This month’s best performing ETF is Market Vectors Russia (symbol RSX). The Russian stock market, like most emerging markets, is recovering from huge losses suffered during 2008 and the first part of this year. If the actual rally persists, this ETF should continue to perform well; however, it will give back its earnings very fast should the bear market mood return. Remember, you should have a well-defined exit strategy in place before buying any ETF or any other investment vehicle, by the way.

RSX – Market Vectors Russia

Is this ETF worth buying right now? Find out what the best performing ETFs are right now and how you can improve your portfolio return. Click here to find more!

Best Performing ETFs Watchlist

Our watchlist contains all ETFs in an uptrend (according to our trading system) that are not included in our Top 3 ETFs Portfolio. We do not issue specific sell signals for the ETFs listed here and do not keep any performance track record but will drop them as soon as our system says the trend is over. You should use your own trading criteria if you decide to invest in those ETFs.

[Content protected for members only. Please login or Click here to become a member]

Top 3 ETFs Portfolio

The top 3 ETFs portfolio show the best 3 ETFs to own right now according to our trading system. Each position is monitored on a daily basis and a sale signal will be issued when the uptrend is over. To see the latest buy/sell signals please visit our trading alerts page.

Must read: how our portfolio work

Top 3 ETFs Portfolio:

[Content protected for members only. Please login or Click here to become a member]

All Closed Trades

Here are all trading recommendations from the beginning of our service with exact buy/sell price, buy/sell date and return. The buy and sell price is the next day market open price (for example, if you issued a buy signal on June 1st the buy price used will be the market open price on June 2nd). Returns are net of fees and taxes.

2009 return: 14.91%

2008 return: 28.82%

Closed trades:

| Symbol | Buy Price | Sell Price | Date Entered | Date Exit | %(P/L) |

| 2011 | |||||

| THD | 71.95 | 67.82 | 04/21/2011 | 05/05/2011 | -5.74 |

| PSCE | 41.12 | 39.51 | 03/28/2011 | 04/13/2011 | -3.92 |

| PXJ | 26.48 | 25.10 | 03/30/2011 | 04/12/2011 | -5.21 |

| IEZ | 66.35 | 64.51 | 03/29/2011 | 04/12/2011 | -2.77 |

| TLT | 92.81 | 91.72 | 03/22/2011 | 03/30/2011 | -1.17 |

| SH | 50.96 | 41.48 | 06/22/2010 | 03/28/2011 | -18.60 |

| 2010 | |||||

| UUP | 23.55 | 25.12 | 02/09/2010 | 05/18/2010 | 6.67 |

| CWB | 37.90 | 38.21 | 12/23/2009 | 05/14/2010 | 0.82 |

| MES | 22.52 | 21.40 | 04/06/2010 | 04/19/2010 | -4.97 |

| DBB | 22.86 | 19.83 | 01/05/2010 | 02/01/2010 | -13.25 |

| 2009 | |||||

| SCZ | 36.49 | 35.35 | 09/11/2009 | 12/23/2009 | -3.12 |

| TUR | 42.80 | 48.27 | 07/27/2009 | 11/19/2009 | 12.78 |

| PGF | 15.08 | 15.60 | 07/17/2009 | 10/22/2009 | 3.45 |

| JJN | 24.67 | 26.48 | 07/23/2009 | 09/09/2009 | 7.34 |

| JJC | 28.00 | 33.55 | 04/08/2009 | 07/17/2009 | 19.82 |

| IDX | 40.05 | 44.35 | 05/11/2009 | 07/01/2009 | 10.76 |

| HHH | 42.16 | 43.05 | 05/06/2009 | 07/01/2009 | 2.11 |

| SLV | 13.16 | 12.00 | 02/11/2009 | 04/07/2009 | -8.81 |

| GLD | 90.70 | 90.29 | 01/30/2009 | 03/16/2009 | -0.45 |

| 2008 | |||||

| XBI | 65.83 | 65.25 | 07/28/2008 | 08/29/2008 | -0.88 |

| OIL | 63.12 | 73.68 | 03/27/2008 | 07/28/2008 | 16.73 |

| GAZ | 60.27 | 69.95 | 04/07/2008 | 07/16/2008 | 16.06 |

| XME | 91.89 | 85.99 | 06/27/2008 | 07/15/2008 | -6.42 |

| SLX | 94.2 | 102.83 | 04/10/2008 | 06/27/2008 | 9.16 |

| IAU | 83.67 | 92.31 | 01/02/2008 | 04/10/2008 | 10.33 |

| SLV | 14.85 | 17.83 | 01/02/2008 | 04/07/2008 | 20.07 |

| DBA | 33.14 | 38.5 | 01/02/2008 | 03/27/2008 | 16.17 |

Closed trades statistics (04/12/2011):

Largest loss: -18.60%

Largest win: 20.07%

% of loosing trades: 44%

% of wining trades: 56%

Average loosing trade: -5.97%

Average wining trade: 10.88%

Recent Comments